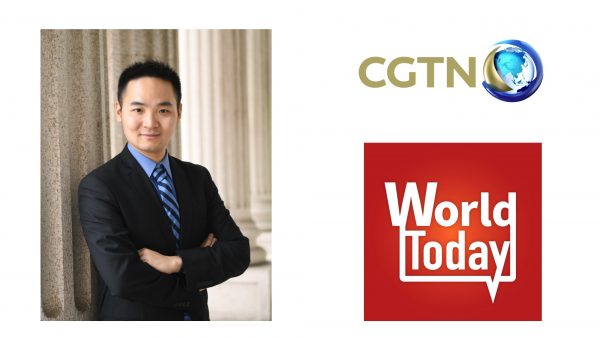

Prof. Sili Zhou shared insights on the new retirement age policy in CGTN World Today

China recently passed legislation to gradually raise the statutory retirement age over a course of 15 years.

China recently passed legislation to gradually raise the statutory retirement age over a course of 15 years. There will also be a requirement for more years of contributions to the pension system in order to access pension benefits.

To what extent can the new policy help China handle an aging population? Prof. Sili Zhou, Associate Professor of the Faculty of Business Administration (FBA) at the University of Macau (UM) and Asian Economics team member of APAEM, joined the panel interview on September 20th, 2024, conducted by the China Global Television Network (CGTN) World Today, with Professor Ronald Lee from the University of California, Berkeley and Professor Baocheng Liu from University of International Business and Economics.

Prof. Sili Zhou agreed that the new retirement age policy is to make better use of human resources and satisfy people’s diverse needs. For example, life expectancy has become much higher, and compared to their parents and grandparents, the younger generations are spending much longer time on education before entering the labor market.

However, in the long term, delaying retirement alone helps fill the gap in social security funding, Prof. Sili Zhou commented that almost all developed countries face a common issue: the government pension system lacks sufficient funds to support the retirement needs of all elderly individuals. Different from U.S., China has a very unique three-pillar pension system (The first pillar is public pensions; the second pillar is mandatory and the third voluntary private accounts). The official launch of the individual pension system in China in 2022 is beneficial for individuals to accumulate additional savings on top of basic pension insurance and enterprise annuities or occupational annuities.

This presents a significant opportunity for Macao to take this advantage to develop a competitive individual pension fund to enter this growing market. Imagine a young graduate in his 20s who works until age 63; his pension savings and investment period could span 40 years or more. The whole pension system will be totally changed.

“We are also welcoming the large-scale entry of pension funds into the stock market. The Cross-boundary Wealth Management Connect Program in Bay Area could be a very good choice. The stock market would be boosted if the pension fund can be invested since they are mostly frequently viewed as a form of ‘long-term stable capital,’” as commented by Prof. Zhou. However, how to design and implement the individual pension system is a significant topic that brings future opportunities for financial industries, particularly in asset management.

For details, please visit: https://radio.cgtn.com/podcast/news/1/Panel-How-will-raising-retirement-ages-help-China-handle-an-aging-population/507984